This is part of a series of influencer blogs for Economist Impact's rEV Index.

While electric cars get most of the spotlight and many countries have announced phaseouts of internal combustion engines (ICEs) for passenger cars, there is a critical segment that is often overlooked: medium- and heavy-duty vehicles, including all freight trucks and buses. This important sector must be tackled urgently and become a part of our climate solution.

First, trucks and buses represent a disproportionate share of road energy and emissions despite being a relatively small share of the road fleet. Second, battery costs have been decreasing rapidly and zero-emission trucks and buses will achieve cost parity with their diesel counterparts much sooner than expected. Finally, electric-drive technology is ready for urban buses and key truck segments with plenty of models available that already meet the operational needs of fleets.

Freight trucks and buses are an effective target for decarbonisation

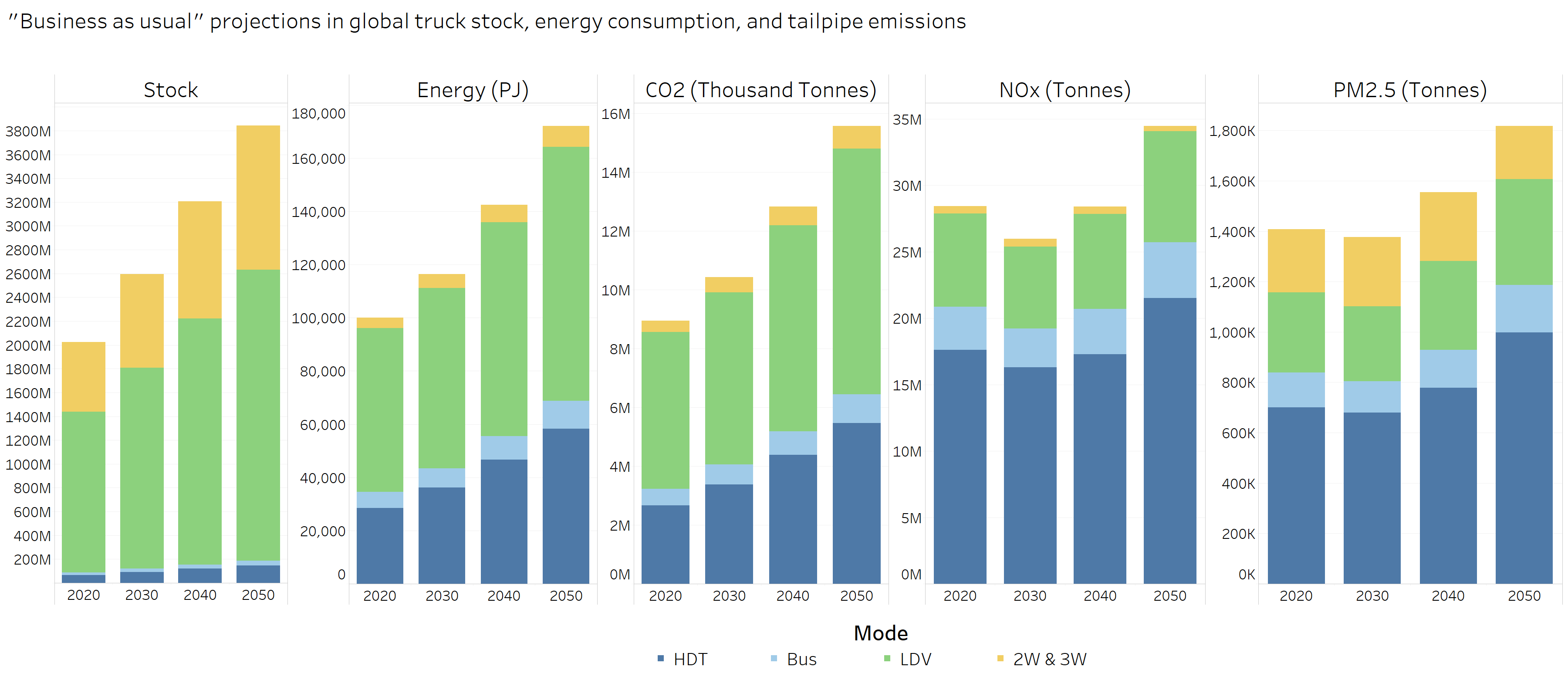

Trucks and buses are responsible for over a third of global on-road fuel and greenhouse gases (GHGs), and more than 70% of on-road nitrogen oxides (NOx) that lead to serious air pollution and health impacts, despite comprising less than 5% of the road fleet today (Figure 1). From an environmental standpoint alone (I’ll get into the economics later), this is an excellent return on investment. If that is not enough to justify investments in their decarbonisation, global truck and bus emissions are forecast to double by 2050—a much faster rate than the transportation sector overall and most other sectors of the economy.

The economics of truck and bus electrification are looking much more favourable

With such a strong business case (from an environmental point of view at least), why aren’t we taking faster action? Some of the challenges are similar to those faced by electric cars, including higher upfront costs, lack of charging infrastructure and range anxiety. But there are specific additional challenges to electrifying buses and trucks. The most obvious is that, from a technology standpoint, it’s harder to electrify heavier vehicles. Battery costs still make EVs more expensive to purchase, which is critical for freight applications since most carriers operate at razor-thin margins. There are also valid concerns about whether ranges are sufficient to meet all fleet operational needs, potential reductions in payload due to additional battery weight, the impacts of long charging times on delivery logistics, and the overall lack of charging infrastructure.

Despite these real challenges, the economic case for truck and bus electrification is clear. They are operated more frequently, travelling for much longer distances and more often than passenger cars. This provides the opportunity for operational savings—it’s much cheaper to operate and maintain an EV due to energy savings and much simpler mechanics—to offset higher capital costs much faster if uncertainties in the residual value of EVs are tackled, for example through first-loss protection programmes or loan guarantees. With increasing reductions in the cost of batteries and other key electric-drive components, we expect cost parity (to own and operate vehicles) to be achieved by 2025-30 for all truck applications

Targeted financial incentives will help accelerate cost parity between electric and ICE technologies, while increasing production volumes will generate economies of scale and further reduce costs in the long term. Innovative financing models—such as charging-, infrastructure-, and transportation-as-a-service, where vehicles and/or charging infrastructure are leased as opposed to owned by fleet operators—can open even greater opportunities for smaller carriers to operate electric trucks and reap their economic benefits.

Technology is already commercially viable for key applications

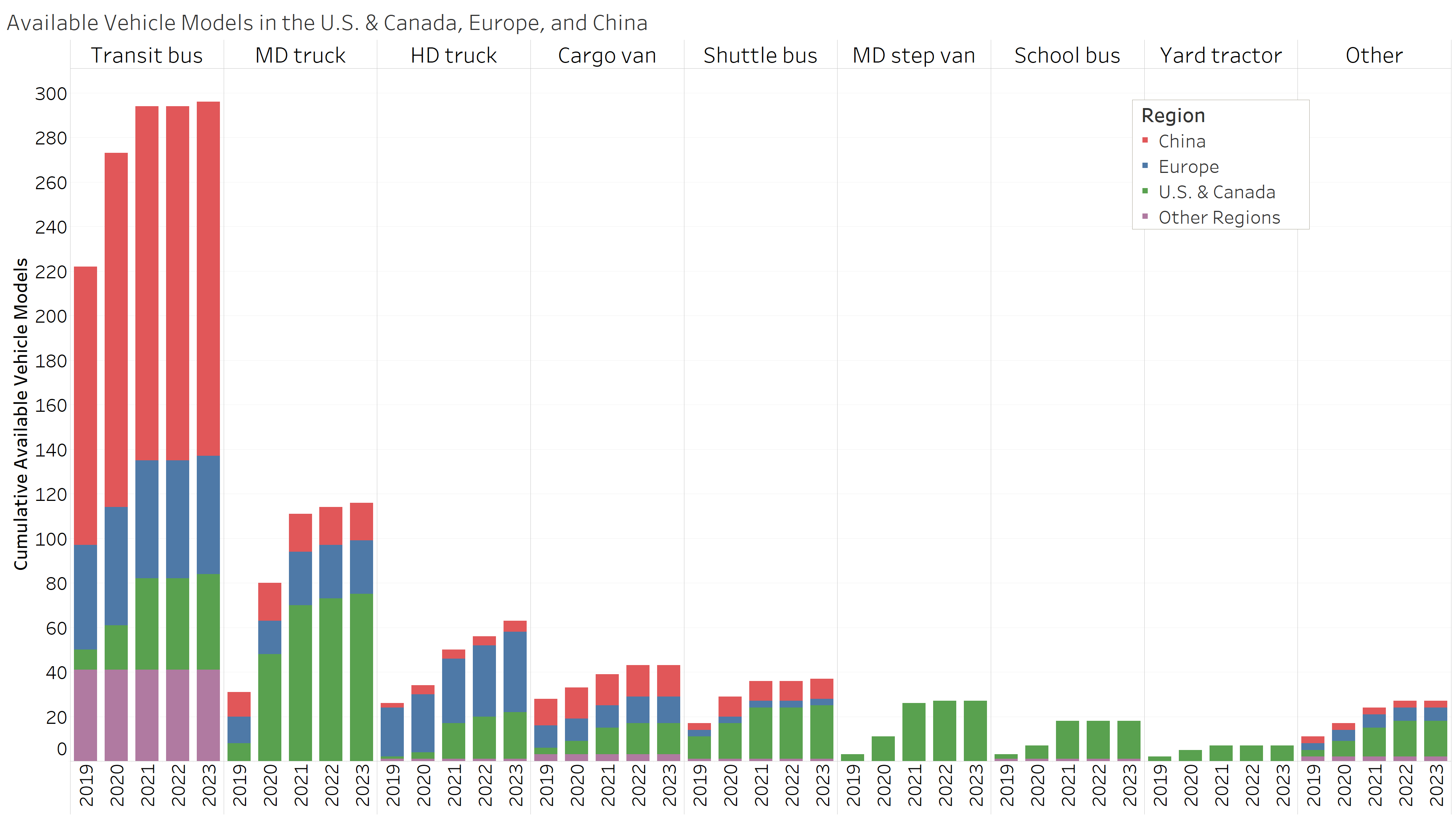

Electrification is already commercially viable and cost-effective for key commercial applications. Electric transit buses are already commonplace in many regions of the world because of the predictable and relatively shorter routes that are conducive to electrification, in addition to the ability to charge overnight at depots without the need for public charging infrastructure. Today, 95% of commercial electric vehicles (EVs) worldwide are buses, with the vast majority deployed in China. Because batteries and electric-drive components used in transit buses can be transferred to other commercial applications such as urban delivery vehicles, and medium- and heavy-duty trucks, we are already seeing increasing numbers of existing and announced zero-emission truck models (Figure 2). While technology is relatively less ready for hydrogen-powered fuel cell vehicles compared to their battery electric counterparts, they might address important parts of the trucking segment, especially for the heaviest vehicles travelling long distances.

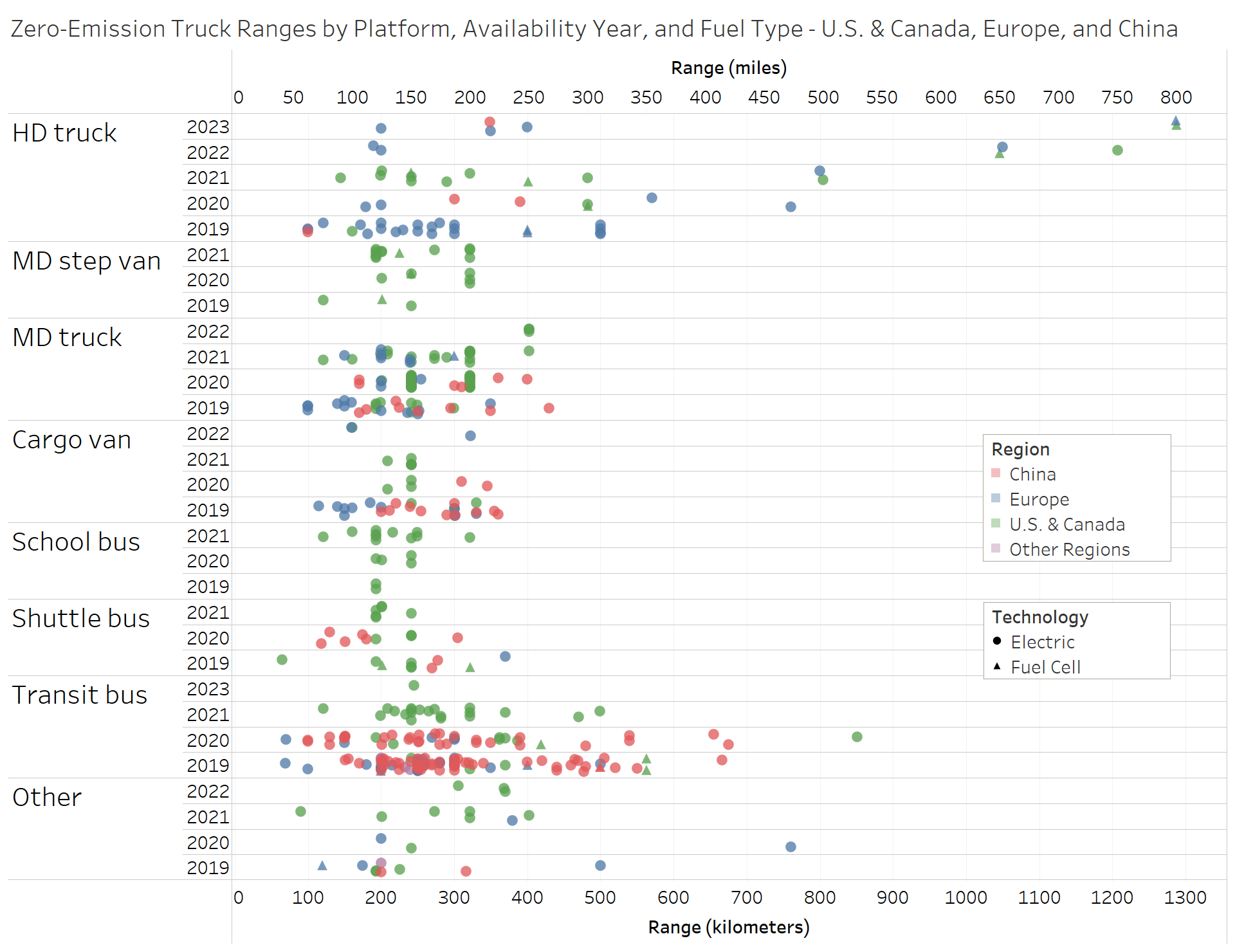

Not only are vehicle models becoming increasingly available, many of them also have ranges that meet fleet operational needs. Figure 3 illustrates the driving ranges of all available and announced models of zero-emission trucks and buses—including both battery electric and fuel cell versions—and compares them with average daily distances travelled by fleets using telematics data from the US. A reasonable share of zero-emission buses and medium-duty trucks can already travel far enough on a single charge to meet logistical needs. As for heavier truck applications, we expect technology to fulfill fleet operational needs in the next two-to-three years. For example, the BYD 8T (200 km/125 miles), Volvo VNR (240 km/150 miles), Lion8 (400 km/250 miles), and Tesla Semi (480 km/300 miles) are models that are already available or will be available soon and that can transport heavier loads over longer distances.

The need for much stronger ambition

Despite the positive environmental and economic business case and accelerating levels of technology readiness, the share of zero-emission truck and bus sales is still minimal relative to ICE sales, and we need much greater ambition. Major truck and bus manufacturers (Scania, Daimler, Volvo, Ford, DAF, Iveco, MAN and others) have already announced ambitious targets for vehicle decarbonisation, aiming at 2040 as the target date when 100% of new sales will be either electric or fossil-free to ensure carbon neutrality by 2050. The “fossil-free” language still leaves the door open for ICEs powered by biofuels, most of which have relatively high GHG emissions and little growth potential due to limited feedstock, or synthetic fuels, which are too expensive and will not reach cost parity until 2050. But, to the extent that such industry ambition will accelerate vehicle electrification, it is an effort to applaud.

Missing is much stronger government ambition towards a full transition to zero-emission technologies for trucks and buses, in parallel with stronger ambition towards zero-emission cars. California provides a great example where a combination of ambitious targets, supported by strong regulations and targeted financial incentives, are laying the foundation for a healthy market for zero-emission trucks and buses. This formula (targets + regulations + incentives) needs to be more widely adopted worldwide.

The good news is that the timing is fortuitous as many countries gear up for stronger climate commitments ahead of COP26. Recognising the current reality of climate change and urgent need to decarbonise, the increasing levels of technology readiness, and projections for cost parity, a group of leading countries is preparing a landmark announcement at COP26. These nations will announce a joint ambition to accelerate the commercialisation of zero-emission trucks and buses, aiming at a full transition towards zero-emission fleets to enable net-zero carbon emissions by 2050. This will align government and industry ambition with the reality of the technology so that zero-emission trucks and buses can become an integral part of our climate solution.

Find out more about EV readiness across the UK and in other important markets in Europe and globally from the rEV Index.

About the author:

Dr. Cristiano Façanha is a transportation and environmental engineer with over 15 years of experience in the transportation industry. Cristiano currently leads CALSTART’s Commercial Vehicle Drive to Zero Program, which aims to accelerate the market of zero-emission trucks and buses worldwide. He is also an expert in the design, modelling, and evaluation of transportation emission reduction strategies and policies. Prior to CALSTART, Cristiano led clean transportation activities related to sustainable freight, Brazil and emission inventory tools at the International Council on Clean Transportation (ICCT). Cristiano holds a PhD in Civil and Environmental Engineering from the University of California at Berkeley, a MSc in Transportation Management from Chalmers University of Technology in Gothenburg, Sweden, and a BSc in Industrial Engineering from the Federal University of Rio de Janeiro.